- #SQUARE QUICKBOOKS ONLINE SETTINGS HOW TO#

- #SQUARE QUICKBOOKS ONLINE SETTINGS MANUAL#

- #SQUARE QUICKBOOKS ONLINE SETTINGS CODE#

Worst case scenario: if that transaction does end up syncing (as things are designed to work with the integration connected), you could simply delete the sales receipt in QuickBooks. As long as you make sure that the transaction does not have a designation after it's saved/recorded in Kindful, that transaction should not sync. Keep in mind, you may have settings in your account that apply designations automatically that you would need to override. Transactions that are not assigned a designation will not sync to QuickBooks.

#SQUARE QUICKBOOKS ONLINE SETTINGS CODE#

Please provide this code to your onboarding specialist or support team representative.Ĭan I enter a transaction into Kindful and have it not sync automatically to QuickBooks? Our development team needs to set this field, but we will need it from you. This is something that is required to have if you happen to have a non-standard tax code. One thing to consider initially pertains to your Default Sales Tax Code. We are a Canadian Organization, and are having trouble with our sync. With this set prior to connecting the integration, as long as the Payment Methods in QuickBooks are strictly the word “Credit”, “Cash”, or “Check”, it will sync without needing custom mappings. Please note that some Transaction Types are not included on this list.Ĭredit, Cash, and Check can will sync however, they need to manually be created as payment methods in QuickBooks prior to connecting the integration. When syncing data from Kindful to QuickBooks, if a corresponding Payment Method does not exist in QuickBooks, Kindful will create one for some of our Transaction Types. It is important to ensure that Payment Methods in QuickBooks are set correctly before connecting the integration. Once the integration is connected, the payment type mappings cannot be remapped.

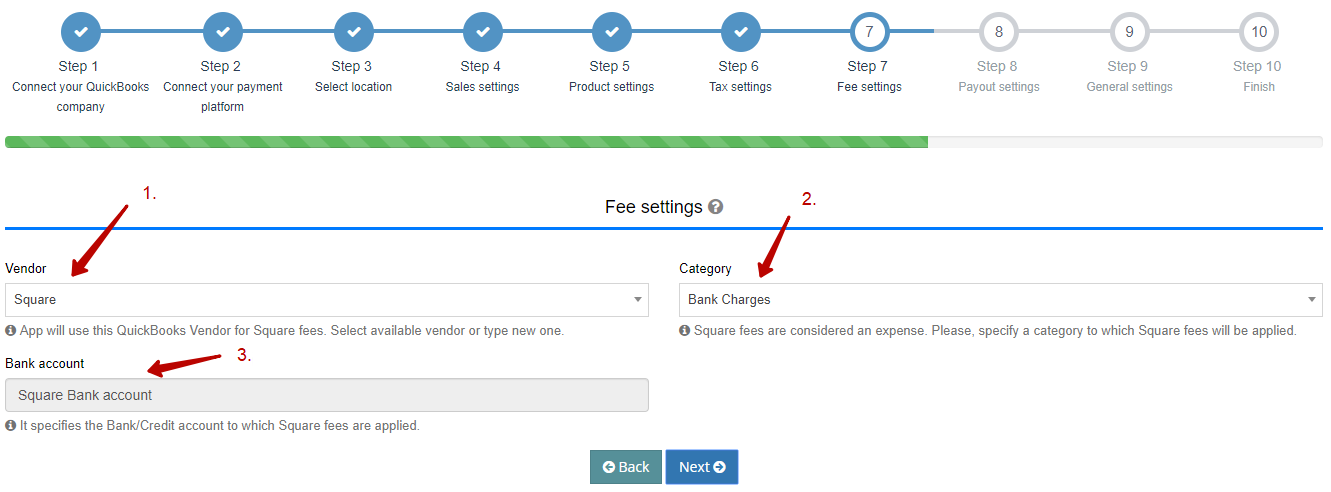

If these types are not used, it will sync over as “Cash”. If you use one of these Payment Methods in QuickBooks, it will automatically sync to the corresponding Kindful field. The following Payment Methods are supported: We map QuickBooks "Payment Methods" into Kindful as "Transaction Types". When data syncs from QuickBooks to Kindful, Kindful currently supports many Payment Methods from QuickBooks. Since the processing fee has now been manually recorded in QuickBooks, you will be able to match your Square or Paypal deposit.The following FAQs apply to Kindful Customers who have integrated QuickBooks with their Kindful account. Go back to Banking and under the Dashboard, locate your deposit under “For Review” tab. Total deposit amount should match your deposit to accept the transaction in bank feed.ħ. Make sure to enter the amount of the processing fee as a negative number so that it deducts from the total deposit amount.Ħ. Record the processing fee part of the transaction under Add New Deposits tab. Select appropriate invoice(s) “Select the payments included in this deposit” tabĥ. Click on the Create or “+” sign and go to “Other” and click on Bank Deposit.Ĥ.

#SQUARE QUICKBOOKS ONLINE SETTINGS MANUAL#

A manual deposit must also be entered (step 3).ģ.

NOTE: To ensure that the associated transaction processing fee is recorded accurately, the invoice payment must be applied manually through the “Receive Payment” screen (rather than through the matching feature). Make sure to select “Deposit-to” that this payment is being deposited into your Undeposited Funds account. Receive Payment of open invoice amount (create “+” sign > customers > receive payment). Identify the customer Invoices that were paid via Square or Paypal.Ģ.

#SQUARE QUICKBOOKS ONLINE SETTINGS HOW TO#

Here’s how to handle fees (Square and Paypal) deducted from Customer payments in QuickBooks Online:ġ. My bank feed under review items from bank link will show $970.00 deposit ($1,000 customer payment less $30 fee). Square (or PayPal) will take their fee off the top and then deposit $970.00 into my business checking account. So when I give a customer an Invoice for $1,000.00, they will swipe their card and have $100 taken from the customer. I will be paying the fee myself, not the customer. This article deals with step-by-step instructions on how to manually recording fees (Paypal or Square) and then match the deposit transactions in bank feed -Review items from your bank and link each item to an existing record.ĮXAMPLE – Signed up for Square (or PayPal) so that I could accept credit cards.

0 kommentar(er)

0 kommentar(er)